Name

Crodls-Supertrend

Author

张超

Strategy Description

This Indicator is using the supertrend with 3 different inputs as confirmation as well as the 200 EMA which will give us the data for an up or down trend. then it is looking for the stoch indicator to confirm if there is a cross under 30 for a long and above 70 for a short.

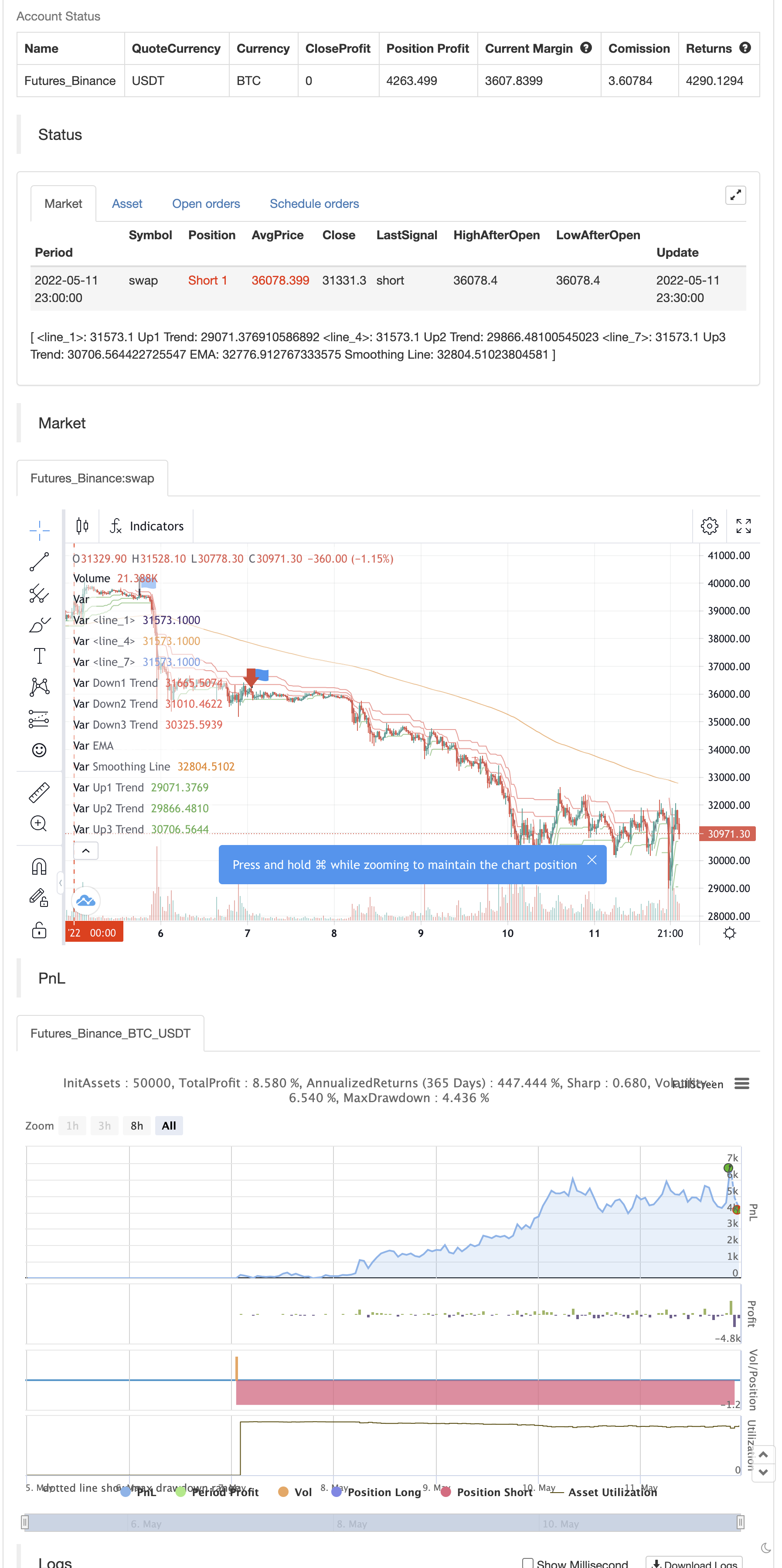

backtest

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 12 | ATR1 Length |

| v_input_float_1 | 3 | Factor1 |

| v_input_2 | 11 | ATR2 Length |

| v_input_float_2 | 2 | Factor2 |

| v_input_3 | 10 | ATR3 Length |

| v_input_float_3 | true | Factor3 |

| v_input_int_1 | 200 | Length |

| v_input_4_close | 0 | Source: close |

| v_input_int_2 | false | Offset |

| v_input_5 | 13 | Length |

| v_input_6 | 7 | MA Length |

| v_input_int_4 | 14 | %K Length |

| v_input_int_5 | true | %K Smoothing |

| v_input_int_6 | 3 | %D Smoothing |

| v_input_string_1 | 0 | (?Smoothing)Method: SMA |

| v_input_int_3 | 5 | Length |

Source (PineScript)

/*backtest

start: 2022-05-05 00:00:00

end: 2022-05-11 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Visit Crodl.com for our Premium Indicators

// https://tradingbot.crodl.com to use our free tradingview bot to automate any indicator.

//@version=5

indicator("Crodl's Supertrend", overlay=true, timeframe="", timeframe_gaps=true)

atrPeriod1 = input(12, "ATR1 Length")

factor1 = input.float(3.0, "Factor1", step = 0.01)

[supertrend1, direction1] = ta.supertrend(factor1, atrPeriod1)

bodyMiddle1 = plot((open + close) / 2, display=display.none)

upTrend1 = plot(direction1 < 0 ? supertrend1 : na, "Up1 Trend", color = color.green, style=plot.style_linebr)

downTrend1 = plot(direction1 < 0? na : supertrend1, "Down1 Trend", color = color.red, style=plot.style_linebr)

atrPeriod2 = input(11, "ATR2 Length")

factor2 = input.float(2.0, "Factor2", step = 0.01)

[supertrend2, direction2] = ta.supertrend(factor2, atrPeriod2)

bodyMiddle2 = plot((open + close) / 2, display=display.none)

upTrend2 = plot(direction2 < 0 ? supertrend2 : na, "Up2 Trend", color = color.green, style=plot.style_linebr)

downTrend2 = plot(direction2 < 0? na : supertrend2, "Down2 Trend", color = color.red, style=plot.style_linebr)

atrPeriod3 = input(10, "ATR3 Length")

factor3 = input.float(1.0, "Factor3", step = 0.01)

[supertrend3, direction3] = ta.supertrend(factor3, atrPeriod3)

bodyMiddle3 = plot((open + close) / 2, display=display.none)

upTrend3 = plot(direction3 < 0 ? supertrend3 : na, "Up3 Trend", color = color.green, style=plot.style_linebr)

downTrend3 = plot(direction3 < 0? na : supertrend3, "Down3 Trend", color = color.red, style=plot.style_linebr)

len = input.int(200, minval=1, title="Length")

src = input(close, title="Source")

offset = input.int(title="Offset", defval=0, minval=-500, maxval=500)

out = ta.ema(src, len)

plot(out, title="EMA", color=color.white,linewidth=2, offset=offset)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

typeMA = input.string(title = "Method", defval = "SMA", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="Smoothing")

smoothingLength = input.int(title = "Length", defval = 5, minval = 1, maxval = 100, group="Smoothing")

smoothingLine = ma(out, smoothingLength, typeMA)

plot(smoothingLine, title="Smoothing Line", color=#f37f20, offset=offset, display=display.none)

//////

l = input(13, title='Length')

l_ma = input(7, title='MA Length')

t = math.sum(close > close[1] ? volume * (close - close[1]) : close < close[1] ? volume * (close - close[1]) : 0, l)

m = ta.sma(t, l_ma)

//////

periodK = input.int(14, title="%K Length", minval=1)

smoothK = input.int(1, title="%K Smoothing", minval=1)

periodD = input.int(3, title="%D Smoothing", minval=1)

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

stochbuy= float(k) < 30 and ta.crossover(k,d)

stochsell=float(k) > 70 and ta.crossover(d,k)

long =(( ((direction1 < 0 and direction2 < 0 ) or (direction2 < 0 and direction3 < 0 ) and (direction1 < 0 or direction3 < 0 ) )and open > out) and t > 0) and stochbuy

short=(( ((direction1 > 0 and direction2 > 0 ) or (direction2 > 0 and direction3 > 0 ) and (direction1 > 0 or direction3 > 0 ) )and open < out) and t < 0) and stochsell

plotshape(long, title = "Long Signal", location=location.belowbar, style=shape.labelup, color=color.green, textcolor=color.white, size=size.small, text="Long")

plotshape(short, title = "Short Signal", location=location.abovebar, style=shape.labeldown, color=color.red, textcolor=color.white, size=size.small, text="Short")

alertcondition(long, title='Long Signal', message=' Buy')

alertcondition(short, title='Short Signal', message=' Sell')

if long

strategy.entry("Enter Long", strategy.long)

else if short

strategy.entry("Enter Short", strategy.short)Detail

https://www.fmz.com/strategy/362916

Last Modified

2022-05-13 17:43:21