Welcome to the Quantitative-Strategy-Portfolio repository, a comprehensive collection of quantitative trading strategies, models, and tools for portfolio management. 💼📊

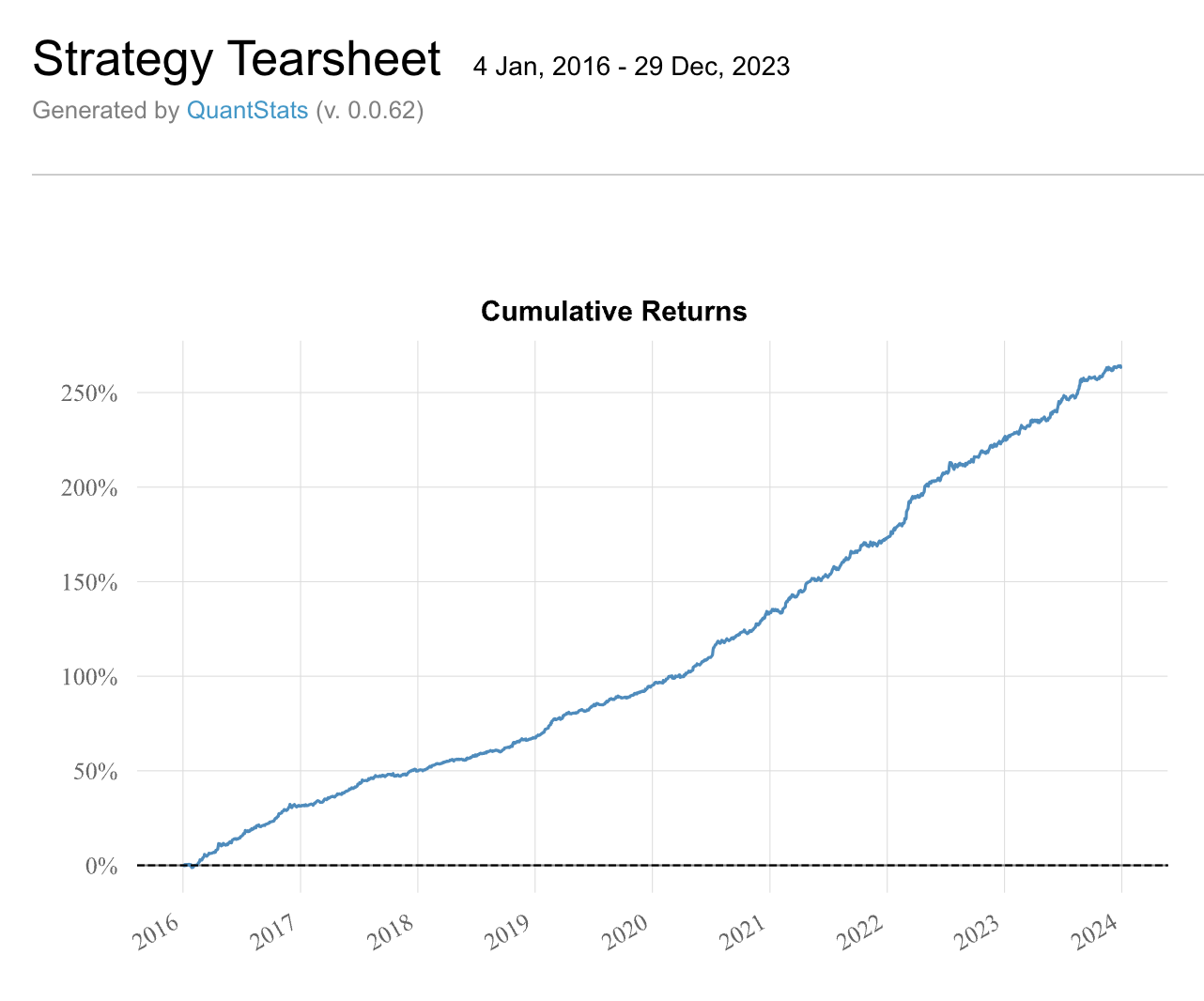

This repository showcases a segment of my strategic portfolio, featuring both the profit and loss (PNL) visualization and the core backtesting framework. It offers a glimpse into the comprehensive approach I've developed for navigating market opportunities. If you are intrigued by the intricacies of my trading strategy and wish to delve deeper into its underlying principles and execution, I cordially invite you to connect with me. Please send an email to [email protected], and I will be delighted to provide you with a more exhaustive overview, including the nuances and insights that shape the strategy's success. I look forward to the opportunity to engage in meaningful discussions and to share the detailed workings of this strategy with you.🧮🌐

- Description: A collection of self-made Commodity Trading Advisor (CTA) strategies.

- Backtest: Using VN.PY framework, see template as example.

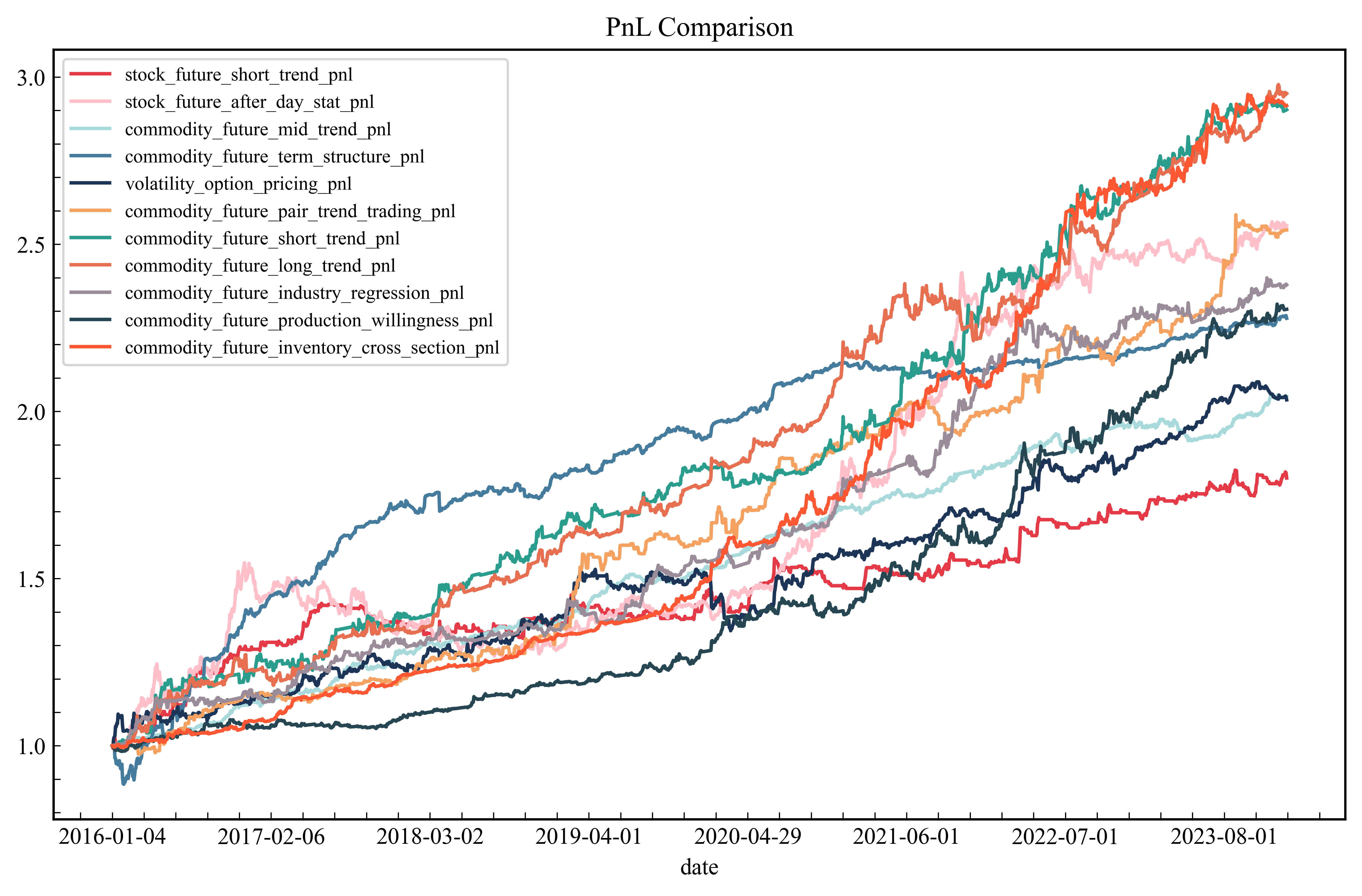

- Sub-Strategy: 'stock_future_short_trend_strategy', 'stock_future_after_day_stat_strategy', 'commodity_future_mid_trend_strategy', 'commodity_future_term_structure_strategy', 'volatility_option_pricing_strategy', 'commodity_future_pair_trend_trading_strategy', 'commodity_future_short_trend_strategy', 'commodity_future_long_trend_strategy', 'commodity_future_industry_regression_strategy', 'commodity_future_production_willingness_strategy', 'commodity_future_inventory_cross_section_strategy'

- OverallPortfolio:

- Description: A collection of deep learning models for cross-sectional strategy

- Backtest: Using qlib framework.

- Description: Replications of sell-side research reports and strategies.

- Description: Models for pricing various types of derivatives, including options and futures.

- Description: Risk management models to assess portfolio risks.

- Model: Fama-Macbeth Regression

- Description: Interview code, self-made cross-sectional framework